KPMG: GCC can build strategic autonomy in a fragmenting global trade order

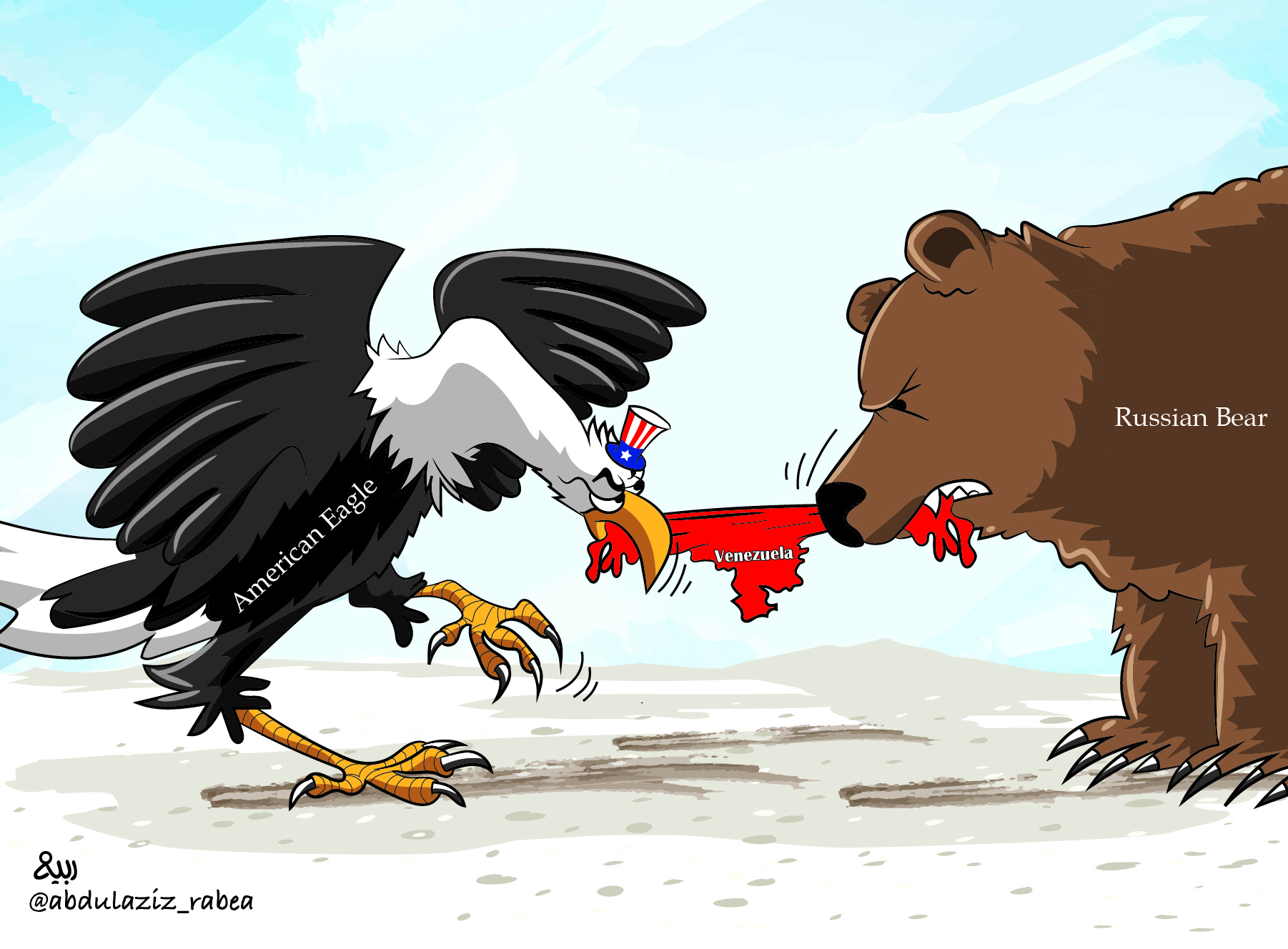

The global economy is entering a more fragmented phase, with trade wars, shifting alliances, and supply chain disruptions increasingly common. A new KPMG Middle East report, Strategic Autonomy in Trade, outlines how the region can strengthen its resilience, reduce external vulnerabilities, and increase its influence in shaping global commerce.

The report highlights that the GCC’s historically open trade model with average tariffs of around five percent has facilitated integration into global markets and enabled broad access to international inputs. This approach has enabled Saudi Arabia to secure the raw materials and machinery essential for its industries, while positioning the UAE as a leading global logistics hub. However, openness has created prosperity but also highlighted structural. Much of the region’s advanced manufacturing, electronics, and precision equipment continues to rely heavily on imports, and in 2024, overall trade volume reached an estimated USD 1.5 trillion, with growth moderating by 4 % percent, underlining the region’s exposure to global shocks.

While all six member states operate under the GCC umbrella, their trade and industrial strategies are diverging. Saudi Arabia, Under Vision 2030, is prioritizing industrial localization and building domestic supply chains across chemicals, metals, pharmaceuticals, and renewable energy components in Riyadh. The UAE, in contrast, is deepening its role as a re-export hub by streamlining customs, negotiating bilateral trade agreements, and leveraging its free zones to attract global investment. Both strategies carry significant merit, but the lack of coordination risks diluting the region’s collective leverage in global negotiations.

Omar Alhalabi, Partner, Head of Economics and Public Policy Advisory at KPMG Middle East, says: “Strategic autonomy in trade is about turning the region’s openness into lasting strength. By coordinating investment in future industries, harmonizing incentives, and negotiating as a bloc, the GCC can build more resilient supply chains, create high-quality jobs, and increase its influence in global commerce. These actions will position the region as a driver of the next phase of trade growth.”

For citizens and businesses, these policy choices have tangible implications. Stronger supply chain resilience can reduce price volatility and protect against shortages, while the localization of industries has the potential to create high-skilled employment opportunities. More broadly, coordinated trade and industrial strategies can provide the region with greater economic stability and a stronger voice in global commerce.

The report concludes that the next few years will be decisive. If member states act with unity and ambition, the GCC can move from being primarily a consumer of global trade dynamics to actively shaping them, transitioning from a price-taker to a price-maker in the evolving global order.